Swing For

The Fences

Lesson 1

Cubicle

Escape

Lesson 2

It's

Your Turn

Lesson 3

Everyday To

Extraordinary

Lesson 4

Midlife

Crisis

Lesson 5

Lesson 3

It’s Your Turn

The Middle-class income range is somewhere between $39,000 to $118,000 per year. It’s no secret that it would be extremely difficult to live on either of these income levels in an urban area like New York or LA-much less feel financially secure. This service will teach you the secrets that could bring you a fortune. It will show you not only what to do but how to do it. Once you learn how to apply the simple, basic techniques revealed here, you will have mastered the secret of true and lasting success.

Listen to what Gary has to say. He was my old boss when I was an elementary school teacher. I was shocked (and flattered) to find out he is an actual paying member of my service as he nears retirement!

In your second assignment, you will learn that your mindset as a trader is not some “fluff” that doesn’t matter, it’s actually one of the most powerful things in your trading arsenal.

1.

Read Kevin’s full story below, and learn how serious your mindset is to your success. (This guy came in too greedy, quit my service, rejoined, and is now about to break $500,000)

—

Fear, Doubt, Regret & Anger: Kevin’s Story

Hello,

I started trading in the last month of 2013 and joined in with Jason Bond Picks. It was a great community of successful traders making a killing. My goals were set extremely low. I intended to start out with a $500 weekly goal. I thought that would be rather simple. Many of you might remember the beginning of 2014 was the pot stock craze and I really didn’t have much experience with trading. Once January hit and marijuana went legal in Colorado, all kinds of trashy pot related stocks were running rampant. One particular pot stock made me over 15k that Jason alerted on my rather small account of 25k.

“That huge win was a blessing and a curse”

That big win gave me a false sense of my expectations from trading and also I began to take on more risk and bigger losses. As I know many others can relate, once that started it became like a snowball rolling down a hill. Later in 2013 I started day trading more and desperately trying other services. No luck. Within a few months I fell below the 25k minimum for day trading and I was beginning to die inside. I felt like my trading was coming to an end if I couldn’t trade freely anymore in and out of trades.

“Fear, doubt, regret, anger …”

Fear, doubt, regret, anger, everything that I’ve been working so hard on was becoming a HUGE FAILURE. Not only was I losing money but I was losing my freedom to do what I always dreamed of.

“It’s not about the money, It’s about the Freedom”

However true that quote is, trading doesn’t work when you’re out of money. I gave up day trading in a few short months and went back to studying and swing trading with Jason. It was unfortunately bad timing in the markets as the summer of 2015 was rough, followed by a huge market flash crash in August. Successful swing trades were few and far between. With my money slowly disappearing and also having to withdraw money to pay bills and survive, I signed up for an account at SureTrader with my credit card. I was spiraling out of control and no one was telling me to stop. I pretty much zeroed out that account in no time. By September 15′ I stopped trading and decided to take a much needed break. Something I hadn’t done up to that point.

I can honestly tell you that if I didn’t take time off, I wouldn’t be here writing this. While I was off, I focused on getting my life together, I sold an investment property that I profited really well on. I knew deep inside that I would go back to trading. There was no way I could let almost 2 years of my life go to waste, all the hours of research and studying. I wouldn’t be able live with myself. I also didn’t want to do anything else. Trading is the ultimate freedom, working for yourself, waking up and going to work in your sweat pants. Am I right!?

“I can’t, I won’t fail at this”

During my time off, I was still keeping track of stocks, sometimes rather jealously hearing of all the big winners the people I followed were racking up. I reflected “big league” on my mistakes and looked at what was effecting my trading so much. Selling my investment property, paying off my credit card debt gave me a fresh start and some money left over to dabble with trading again, but this time SMARTER, more DISCIPLINED, more PATIENT. In December 2015, I re-funded my account at Etrade and just sat there. I didn’t do any trades for a whole week. I was so scared to make one mistake and fall right back in to my old ways. I was afraid to let myself down again. That led me to my next realization, trading SCARED was no way to trade and thats how I spent my first 2 years.

I really had to clean my slate and start over, but I needed help. Over my time off I was still following Jason, he was back to making some good money and ended the year with a great return. I knew there was others out there but no one really matched him and his down to earth style. I’ve been where he’s been, college and credit card debt, a job that felt like a dead end. Now he’s driving Land Rover’s and paying cash for everything. That December I decided if I was going to make it, I was going to invest in myself and pony up the money to join Jason’s Mentor program called Millionaire Roadmap.

“This was make or break for me. Do or Die.”

With a clean slate, no debt, a fresh start being able to look over a traders shoulder who was consistently making huge returns. IT WAS THE GREATEST DECISION I EVER MADE! I started 2016 out fairly slow, quiet and extremely focused and disciplined. I ate, drank and breathed trading again.

“My first month I made $19k.”

I never even stopped to think about it, still afraid I would lose it, having that feeling in my stomach every time I took a trade.

“My Second month, $18k.”

I was on a mission and didn’t want to stop until I made everything I lost back and by March I hit the 50k mark. I made it all back. From that point on I started to get more confident, my risk threshold was increasing to where before I had none. That is no way to trade. I continued the year with the pedal to the floor.

My grand total for the year was around 225k. I am still in shock. Jason’s mentorship and surrounding myself by the masterminds in his program turned my trading around. I refused to become a statistic and be another trader that failed. Surrounding myself by successful traders, people who were smarter than me helped me so much. I started to see all the mistakes I was making. I took control of my anxiousness, FOMO (Fear of missing out), chasing stocks and stressing all the time. Jason helped me build my confidence again and get back to consistent winners. He gave me the tools and I took if from there.

I’m so thankful to Jason and his team for helping me get through the hardest and trying time in my life. I fought through, maybe too hard. While others were sleeping, I was working, studying. I was not going to give up but just underestimated how incredibly tough this job would be, but also now looking back the most rewarding. It’s so important to trade from a good place emotionally and financially. You can’t go to a casino with $20 expecting to win it big. It takes time and patience. Small wins over time add up. You have to be patient! I can’t stress it enough. If you’re trying to make it big, you will lose your money.

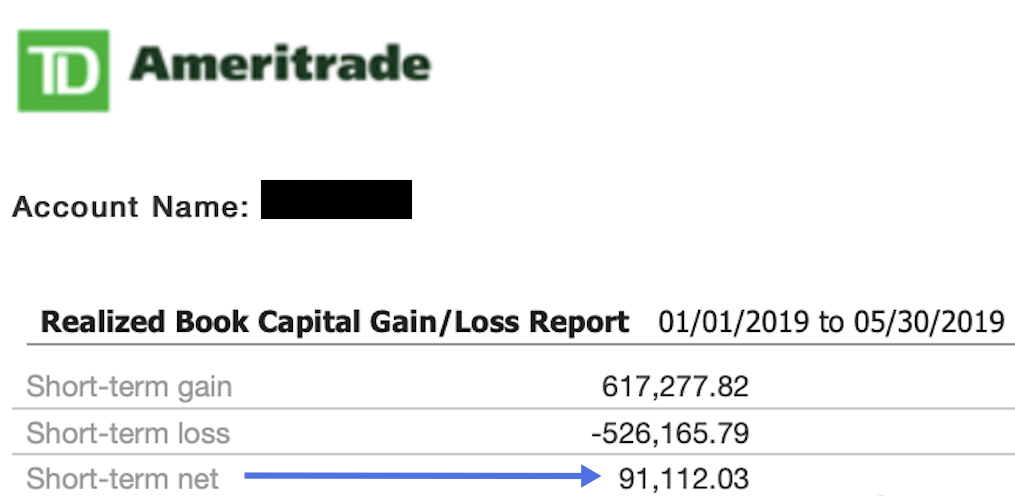

“In 2017, Kevin made over a 136% gain, or + $78K in returns, trading all on his own. In 2018, that number leapt to over $134K. This year, halfway through 2019, he has already secured over $90K.

Jason has given me the foundation to trade stocks for the rest of my life!”

– Kevin

2.

There’s a common occurrence with new traders. They frequently struggle if they don’t have the guidance they need to understand the costly mistakes they can make.

Matt Campbell, who is now a full time trader, followed a similar path. It goes to show you how “practice only makes perfect when practicing correctly.”

(Testimonial Exerpt)

Initially, when I wanted to get into stock trading, I made some big mistakes. I’ve been trading for about 5 years now, but since then I found Jason Bond Picks… I still made some mistakes, but here’s how I looked at it. Money I lost was like a tuition. It’s really like a four-year education in college and I only wish I had gotten into this a lot sooner because now I feel very confident in what I’m doing, and it didn’t take that long at all. So anyway, I had a very good year last year, so I actually left my job about 21 days ago and now I’m trading full-time. Happy to say almost, I think, 16 or 17 straight green days in a row… I just put my total focus into it. I’m definitely happy with the move.

Jason Bond

I graduated in 2001 with a Masters in Education and began to teach in NYS public schools. After ten years of teaching, I was unable to gain any traction financially as I accumulated over $250,000 in debt due to a mortgage, student loans and credit cards.

I knew that something needed to change. I was introduced to the stock market and through the help of my mentor, Jeff Bishop, I began seeing results. Jeff had been actively trading for 15 years when he first started guiding me and his experience was what allowed me to accelerate my learning curve and get me on the right track…much quicker than expected!

That is exactly why I came up with my Millionaire Roadmap. The goal to build a community that can follow and learn from me as I pursue my next $1,000,000 in trading profits.

Trading is not easy, and I’ve certainly had my shares of losing trades to go along with my winning ones. With the Millionaire Roadmap, you learn from traders who have made mistakes on their way to the success they have today.

Now, you have the opportunity to learn directly from both myself, my team and the what I consider the most elite trading community online!

I wish you the best on your Millionaire Roadmap application!

DISCLAIMER: To more fully understand any Ragingbull.com, LLC (“RagingBull”) subscription, website, application or other service (“Services”), please review our full disclaimer located at https://ragingbull.com/disclaimer.

FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT INVESTMENT ADVICE. Any RagingBull Service offered is for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation, or be relied upon as personalized investment advice. RagingBull strongly recommends you consult a licensed or registered professional before making any investment decision.

RESULTS PRESENTED NOT TYPICAL OR VERIFIED. RagingBull Services may contain information regarding the historical trading performance of RagingBull owners or employees, and/or testimonials of non-employees depicting profitability that are believed to be true based on the representations of the persons voluntarily providing the testimonial. However, subscribers’ trading results have NOT been tracked or verified and past performance is not necessarily indicative of future results, and the results presented in this communication are NOT TYPICAL. Actual results will vary widely given a variety of factors such as experience, skill, risk mitigation practices, market dynamics and the amount of capital deployed. Investing in securities is speculative and carries a high degree of risk; you may lose some, all, or possibly more than your original investment.

RAGINGBULL IS NOT AN INVESTMENT ADVISOR OR REGISTERED BROKER. Neither RagingBull nor any of its owners or employees is registered as a securities broker-dealer, broker, investment advisor (IA), or IA representative with the U.S. Securities and Exchange Commission, any state securities regulatory authority, or any self-regulatory organization.

WE MAY HOLD SECURITIES DISCUSSED. RagingBull has not been paid directly or indirectly by the issuer of any security mentioned in the Services. However, Ragingbull.com, LLC, its owners, and its employees may purchase, sell, or hold long or short positions in securities of the companies mentioned in this communication.